Featured

Table of Contents

- – How does an Guaranteed Income Annuities help w...

- – Is there a budget-friendly Annuity Payout Opti...

- – Why is an Tax-deferred Annuities important fo...

- – What is the best way to compare Annuities For...

- – How do I cancel my Guaranteed Income Annuities?

- – How long does an Annuity Accumulation Phase ...

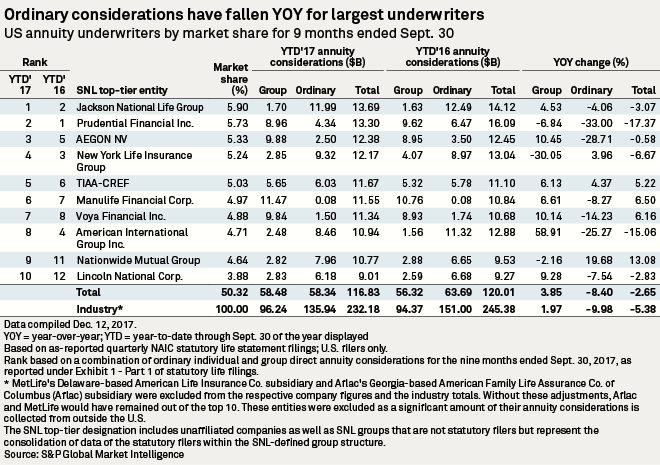

Note, nonetheless, that this does not state anything about changing for inflation. On the bonus side, even if you presume your choice would certainly be to spend in the supply market for those seven years, which you 'd obtain a 10 percent annual return (which is much from particular, particularly in the coming decade), this $8208 a year would certainly be greater than 4 percent of the resulting small supply value.

Instance of a single-premium deferred annuity (with a 25-year deferment), with 4 settlement alternatives. Politeness Charles Schwab. The month-to-month payout below is greatest for the "joint-life-only" alternative, at $1258 (164 percent greater than with the instant annuity). However, the "joint-life-with-cash-refund" option pays out only $7/month less, and guarantees a minimum of $100,000 will certainly be paid.

The method you purchase the annuity will identify the solution to that question. If you buy an annuity with pre-tax dollars, your costs decreases your gross income for that year. Eventual payments (month-to-month and/or swelling sum) are exhausted as routine revenue in the year they're paid. The benefit below is that the annuity might allow you postpone taxes beyond the IRS payment limitations on IRAs and 401(k) plans.

According to , acquiring an annuity inside a Roth plan leads to tax-free repayments. Buying an annuity with after-tax bucks beyond a Roth results in paying no tax obligation on the portion of each settlement credited to the original costs(s), but the continuing to be section is taxed. If you're establishing an annuity that starts paying before you're 59 years old, you might need to pay 10 percent early withdrawal penalties to the internal revenue service.

How does an Guaranteed Income Annuities help with retirement planning?

The expert's very first step was to establish a detailed economic prepare for you, and then discuss (a) just how the recommended annuity fits right into your overall strategy, (b) what choices s/he taken into consideration, and (c) how such choices would or would not have led to lower or greater compensation for the consultant, and (d) why the annuity is the exceptional choice for you. - Annuity accumulation phase

Certainly, an advisor might try pushing annuities even if they're not the very best fit for your situation and objectives. The reason might be as benign as it is the only product they offer, so they fall victim to the typical, "If all you have in your tool kit is a hammer, rather quickly everything starts looking like a nail." While the advisor in this scenario might not be underhanded, it increases the threat that an annuity is an inadequate selection for you.

Is there a budget-friendly Annuity Payout Options option?

Considering that annuities usually pay the representative offering them a lot higher payments than what s/he would obtain for spending your money in shared funds - Annuity payout options, not to mention the zero payments s/he would certainly get if you buy no-load common funds, there is a big reward for representatives to push annuities, and the a lot more complicated the far better ()

An unscrupulous expert recommends rolling that quantity into new "better" funds that just take place to lug a 4 percent sales load. Concur to this, and the expert pockets $20,000 of your $500,000, and the funds aren't most likely to carry out better (unless you selected much more inadequately to begin with). In the very same instance, the consultant can guide you to buy a difficult annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The expert hasn't figured out just how annuity repayments will certainly be tired. The expert hasn't disclosed his/her settlement and/or the costs you'll be billed and/or hasn't shown you the effect of those on your ultimate repayments, and/or the compensation and/or fees are unacceptably high.

Present interest prices, and therefore predicted repayments, are historically low. Even if an annuity is appropriate for you, do your due persistance in comparing annuities sold by brokers vs. no-load ones sold by the providing business.

Why is an Tax-deferred Annuities important for my financial security?

The stream of monthly repayments from Social Safety resembles those of a delayed annuity. A 2017 relative evaluation made an extensive comparison. The adhering to are a few of one of the most significant factors. Because annuities are volunteer, the people buying them typically self-select as having a longer-than-average life span.

Social Security advantages are completely indexed to the CPI, while annuities either have no rising cost of living defense or at many provide an established percent yearly increase that might or might not compensate for rising cost of living completely. This kind of rider, as with anything else that raises the insurance provider's danger, requires you to pay even more for the annuity, or accept reduced settlements.

What is the best way to compare Annuities For Retirement Planning plans?

Please note: This post is planned for informational purposes just, and should not be thought about economic suggestions. You ought to get in touch with a financial expert before making any type of major economic choices. My job has actually had many uncertain weave. A MSc in theoretical physics, PhD in speculative high-energy physics, postdoc in bit detector R&D, research study setting in speculative cosmic-ray physics (consisting of a couple of check outs to Antarctica), a quick job at a tiny design solutions firm supporting NASA, adhered to by starting my very own small consulting method supporting NASA tasks and programs.

Given that annuities are meant for retirement, tax obligations and penalties may apply. Principal Defense of Fixed Annuities. Never ever shed principal due to market performance as taken care of annuities are not bought the marketplace. Also throughout market slumps, your money will certainly not be influenced and you will not lose cash. Diverse Investment Options.

Immediate annuities. Made use of by those who want trusted income promptly (or within one year of acquisition). With it, you can customize income to fit your needs and create revenue that lasts forever. Deferred annuities: For those that intend to grow their money in time, yet want to postpone access to the cash till retirement years.

How do I cancel my Guaranteed Income Annuities?

Variable annuities: Provides greater potential for development by investing your money in financial investment alternatives you pick and the ability to rebalance your profile based on your preferences and in a manner that lines up with altering financial goals. With fixed annuities, the business spends the funds and supplies a rate of interest to the customer.

When a death case takes place with an annuity, it is very important to have a called beneficiary in the agreement. Various options exist for annuity survivor benefit, depending upon the contract and insurance firm. Choosing a reimbursement or "period specific" choice in your annuity offers a survivor benefit if you die early.

How long does an Annuity Accumulation Phase payout last?

Naming a recipient other than the estate can aid this procedure go much more smoothly, and can assist ensure that the profits go to whoever the specific wanted the cash to go to rather than going with probate. When existing, a fatality benefit is automatically included with your agreement.

Table of Contents

- – How does an Guaranteed Income Annuities help w...

- – Is there a budget-friendly Annuity Payout Opti...

- – Why is an Tax-deferred Annuities important fo...

- – What is the best way to compare Annuities For...

- – How do I cancel my Guaranteed Income Annuities?

- – How long does an Annuity Accumulation Phase ...

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Indexed Annuity Vs Fixed Annuity Is

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Pros and Cons of Fixed Index Annuity Vs Variable Annuity Why Choo

Understanding Financial Strategies Key Insights on Your Financial Future Defining Fixed Index Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing the Right Financial Strategy

More

Latest Posts